Why Are Deductibles Going

Through the "Roof"?

In 2020, there were 980 different events that cost insurance companies $210 billion in losses globally, mostly related to catastrophic events such as hurricanes, hail, and tornadoes. This was followed by 2021 being the third-most active hurricane season on record, producing 21 named storms, including Hurricane Ida which struck southeastern Louisiana at Category 4 strength and causing over $75 Billion in damages.

Severe hurricane damage in 2021 led to losses of $7.2 Billion and to the insolvency of eight insurers in Louisiana alone. In response and in an effort to be profitable, insurance companies have done two things to remain in business: raise premiums and raise deductibles.

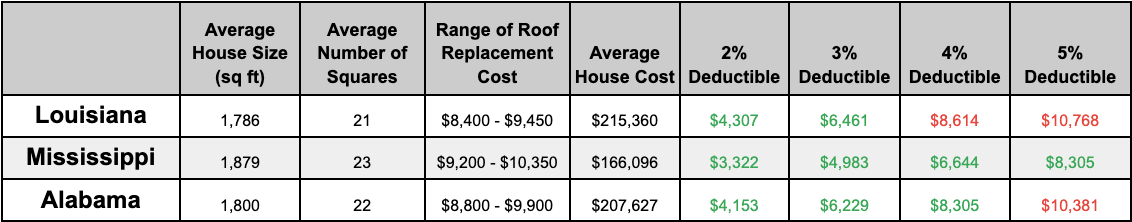

Most insurance companies are starting to change from traditional flat-amount deductibles to percentage-based deductibles, ranging from 2-5%. These storm-damage deductibles are often classified under a different policy from normal deductibles like theft or fire damage. A traditional policy has a $1,000 standard deductible, in this case, the policyholder must pay the first $1,000 of the claim out of pocket before coverage kicks in. However, percentage deductibles are based on the insured value of a home. For example, if a house is insured for $300,000 and has a 5% deductible, the first $15,000 of a claim must be paid out of the policyholder’s pocket before the first dollar is paid out. This means that the cost of roof replacement can be less than the deductible, forcing the homeowner to pay 100% of the costs out-of-pocket, with no help from their insurance. (See Table Below)

The table displays the average cost of roof replacement and the average deductibles based on percentage and average home value. As you can see, homeowners with a 3% deductible end up having to pay over half of the costs for roof replacement. Once deductibles exceed 4%, homeowners end up paying for most, if not all the costs out of their own pockets.

There are still thousands of roofs that need repair or replacement, so why are homeowners “holding out” on fixing their roofs? While there are many answers, here are the three most common ones:

Homeowners are still fighting with their insurance companies to get funds from claims.

Homeowners are wary of replacing their roofs while still in hurricane season, concerned that another may just be around the corner.

Homeowners that have high, percentage-based deductibles may not have the cash on hand to pay for the roof out of pocket.

This now brings the question: how do I convince a homeowner to fix their roof when they do not have the funds to pay for it? One recommendation is to offer financing. While most small to mid-size roofers rely on homeowners to find their own financing, things have changed. Over the last few years, several financial companies have emerged that want to partner with roofers like you so that you can start offering your customers the financing that they need to pay for their roofs. Here are a few popular ones: GreenSky, PowerPay, & EnerBankUSA.

These institutions help provide your customers with a monthly payment option, making it more affordable to them. Which in turn, gains you more business and opportunities. You can apply for these options by clicking on their name in the article and then following their instructions on their site.

If you have any questions or concerns about this article or the facts stated in it, please email Brett.